If your New Year’s Resolution is to make 2024 the year you get your financial life organized, Iowa State Bank can help. Our account alerts found in Online Banking and in Mobile Banking give you over 50 different alerts that you can use to manage your accounts. Choose from the following areas:

- Security Alerts – Get alerts if someone changes your information or is trying to get access to your online banking. Alerts include:

- Online banking password was changed

- Online banking was locked out

- Address change

- Online banking address changed

- Name was changed

- Phone number was changed

- Email address was changed

- eStatement enrollment settings have changed

- Invalid login attempt for online banking

- Login ID for online banking has changed

- Balance Alerts – Low balance alerts can help you avoid overdrafts or help you maintain a minimum balance requirement. High balance alerts can help you identify when you might want to transfer or invest money. Balance alerts include:

- Account balance below threshold (you set the dollar amount)

- Account balance above threshold (you set the dollar amount)

- Account was overdrawn

- Scheduled balance

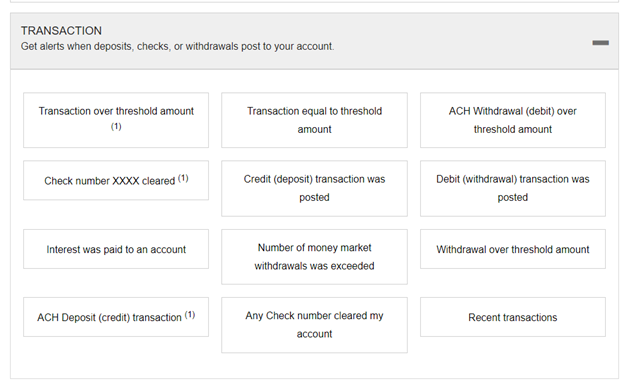

- Transaction Alerts – Get alerts when deposits checks or withdrawals post to your account including:

- Transaction over threshold amount

- Transaction equal to threshold amount

- ACH Withdrawal (debit) over threshold amount

- Check number XXX cleared

- Credit (deposit) transaction was posted

- Debit (withdrawal) transaction was posted

- Interest was paid to an account

- Number of money market withdrawals was exceeded

- Withdrawal over threshold amount

- ACH Deposit (credit) transaction

- Any check number cleared my account

- Recent transactions

- Transfer Alerts – Get alerts when incoming or outgoing transfers post to your account such as:

- Outgoing scheduled/automatic transfer over threshold amount

- Incoming scheduled/automatic transfer over threshold amount

- Transfer failed

- Loan Alerts – Get notice when a payment is due, past due, paid or when any other loan activity occurs.

- Scheduled loan payment is due

- Payment was posted to a loan

- Loan advance was posted

- Loan is past due

- Loan payment due

- Escrow refund check was issued

- Escrow payment amount was changed

- Payment amount was changed

- Rate was changed

- Other Alerts – A variety of other alerts for various account activities area available to help you manage your money:

- Fee was charged to an account

- Account status changed

- Stop payment placed on an account

- Statement generated

- Safe deposit box rent is due

- Safe deposit box rent is pas due

- Return of an ACH debit

- Broadcast alerts – Messages sent by the bank that could be important relating to system outages, weather or offices affected by natural disaster.

- Debit Card Alerts – While mobile banking users can turn their debit card on and off, set travel notices and create spending restrictions, a number of alerts are available for debit card users with our account alerts:

- Card transaction over threshold amount (you set the dollar amount)

- Card ATM limit has been changed

- New card has been ordered

- Card Point-Of-Sale (POS) limit changed

- Card status has changed

Use account alerts to get the information you want and need. Choose as many or as few as you wish. You can even choose the types of notifications you receive, and during what times of day you will receive them. For example, some users like to sunset their alerts until 7 AM so that they do not receive notifications during sleeping hours.

If you have questions about account alerts, see a personal banker at your local Iowa State Bank office, or call us at 515.295.3595.

Business Tips Consumer Tips Cybersecurity Fraud Prevention General Saving Money

January 2, 2024 by Iowa State Bank