Grow and Focus Your Savings

Sometimes you want to earn more than you’ll find with a traditional savings account. With a certificate of deposit (CD), you can focus your saving efforts and be rewarded with a higher interest rate while you securely grow your money. Your rate is determined by your deposit and term length. At Iowa State Bank, we offer a wide range of CD options available for customers of all ages. If you’re interested in focusing your savings, please contact us online or visit your local branch office.

Certificate of Deposit Options*

| Traditional CD | Junior Saver CD | American Dreams CD | Plus CD | Rate Climber Options | |

|---|---|---|---|---|---|

| Perfect for you if… | Perfect for you if…You want to choose a term to meet a financial goal. A variety of terms are available. | You have a child under 23 and want to jump start their financial journey. | You want a low-cost CD that you can add to as income becomes available. | You want a CD with a variable rate and the ability to add to as needed. | You want to take advantage of potential increases in CD rates. |

| Important Things to Know | Minimum deposit of $1,000. | Minimum deposit of $500. | Open for $100; add $50 at any time during the CD’s term; additions can be made from your checking account. | Minimum balance of $1,000 required; make additions of $250 or more at any time during the CD’s term; quarterly withdrawals available during first 10 days of each quarter. | Only available with CD’s with 24-month term; boost your interest rate once during the term. |

*Early Withdrawal Penalties may apply

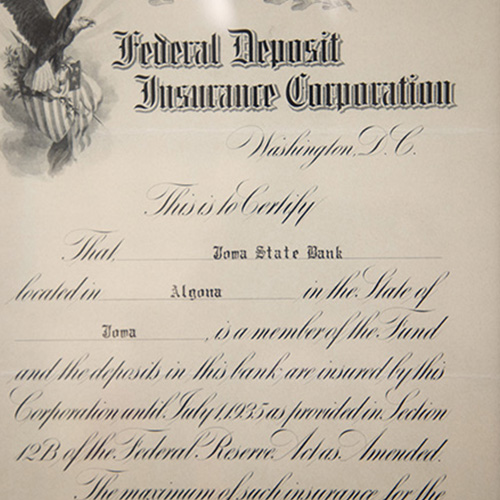

CDARS® Service

Certificate of Deposit Account Registry Service

With the CDARS® service you can access multi-million-dollar FDIC protection by working directly with just our bank.

- Rest assured. Know that deposits well into the millions are eligible for FDIC insurance protection.

- Earn interest. Put cash balances to work in CDs.

- Keep it simple. Avoid opening multiple accounts with multiple institutions to protect your funds. Forego the need to use repo sweeps, track collateral on an ongoing basis, and manually consolidate statements and disbursements from multiple banks.

- Manage liquidity. Select from multiple terms to meet your liquidity needs.

- Support your community. Feel good knowing that the full amount of funds placed through CDARS can stay local to support lending opportunities that build a stronger community.1

Contact us to learn more.

- When deposited funds are exchanged on a dollar-for-dollar basis with other institutions that use CDARS, our bank can use the full amount of a deposit placed through CDARS for local lending, satisfying some depositors' local investment goals or mandates. Alternatively, with a depositor's consent, our bank may choose to receive fee income instead of deposits from other participating institutions. Under these circumstances, deposited funds would be be available for local lending.

Deposit placement through CDARS or ICS is subject to the terms, conditions, and disclosures in applicable agreements. Although deposits are placed in increments that do not exceed the FDIC standard maximum deposit insurance amount (“SMDIA”) at any one destination bank, a depositor’s balances at the institution that places deposits may exceed the SMDIA (e.g., before settlement for deposits or after settlement for withdrawals) or be uninsured (if the placing institution is not an insured bank). The depositor must make any necessary arrangements to protect such balances consistent with applicable law and must determine whether placement through CDARS or ICS satisfies any restrictions on its deposits. A list identifying IntraFi network banks appears at https://www.intrafi.com/network-banks. The depositor may exclude banks from eligibility to receive its funds. IntraFi and ICS are registered service marks, and the IntraFi hexagon and IntraFi logo are service marks, of IntraFi Network LLC.